Students hope for debt relief as government wavers on amount

February 22, 2021

Student debt forgiveness has been a major topic of conversation during the start of the Biden presidency, and students at UK are joining the discussion.

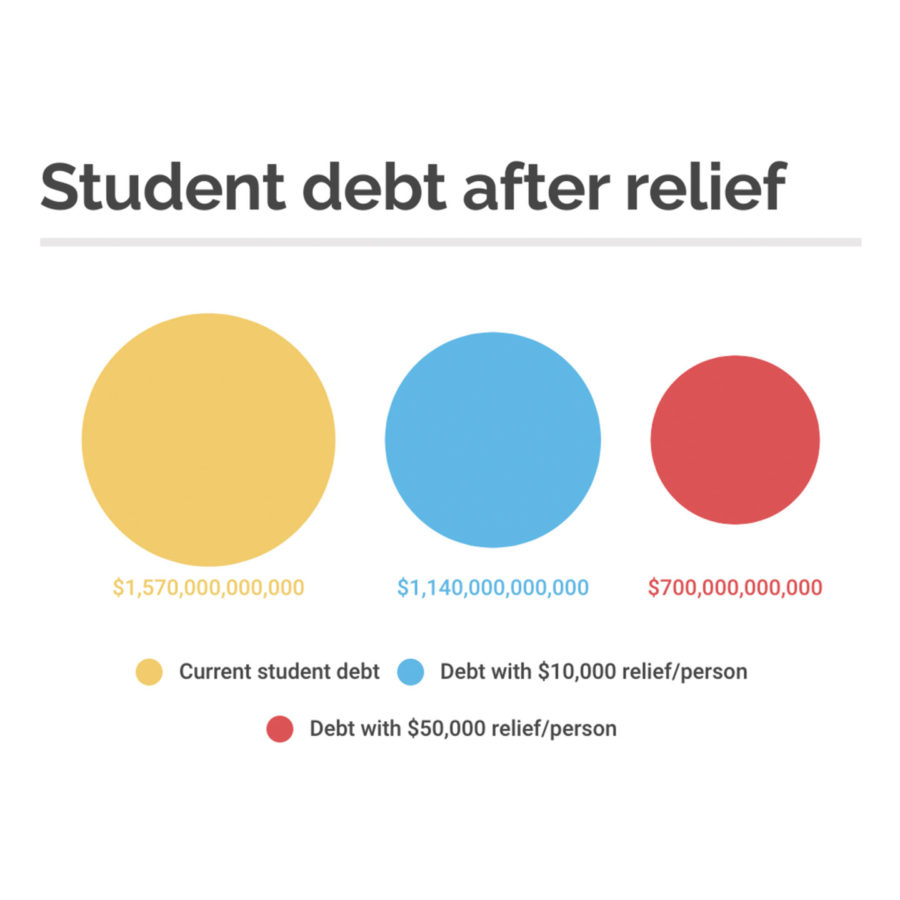

According to the annual Federal Student Loan Portfolio, as of September 2020, the total U.S. student federal loan debt numbers $1.57 trillion with 42.9 million borrowers across the country. With these numbers, the average federal student debt per borrower would be about $36,596.

The portfolio also includes a breakdown of state numbers. Kentucky totals $19.1 billion in federal student debt borrowed by 585,500 Kentuckians. With these numbers, the average federal student debt per borrower in Kentucky comes out to be around $32,621.

According to the report, 106,900 Kentuckians ages 24 and younger owe $1.53 billion out of the total student debt for the state. This would put the current average federal student loan debt for Kentuckians age 24 and younger around $14,312.

Though this number seems low in comparison to the others, members of this age group are still in school and are expected to continue borrowing for several years, so there is likely great variation between the average debt of this group. They can expect their debt to continue growing as they continue through college and accumulate interest.

Therefore, the overage statewide average provides a more accurate picture to use when discussing student loan forgiveness, since many of these young borrowers will likely end up owing somewhere around this amount once they have finished school.

Biden’s plan for forgiving student debt starts with eliminating $10,000 from each borrowers’

federal student debt. Biden plans to take this action through Congress. though no legislation has been proposed yet.

According to the Federal Student Loan portfolio, 15.3 million federal student loan borrowers, more than a third of total federal borrowers, owe less than $10,000. This legislation would eliminate debt for all of those borrowers and drop the total outstanding federal debt by $429 billion to around $1.14 trillion, a decrease of more than 25 percent.

However, members of Congress, including Senate Majority Leader Chuck Schumer and Sen. Elizabeth Warren, have called on Biden to do more in terms of student debt relief, by signing an executive order forgiving $50,000 per borrower.

That kind of forgiveness would total over $2 trillion if every borrower needed the full $50,000.

But because some people owe less than $50,000 and the difference would not transfer to another person, that possible $2 trillion would not eliminate federal student debt.

Still, $50,000 in loan forgiveness would relieve the entirety of debt for 80 percent of borrowers, or 36 million people. Those with more than $50,000 in loans would still be obligated to repay the remainder.

The remaining amount of debt would total $700 billion, less than half of its current value.

But the legality of passing such a costly legislation through executive order has been called into question numerous times since this proposal, and President Biden said that he was not in support of the plan.

Students across the country are paying close attention to the discussion around student debt forgiveness because of its potential effect on their own financial situation.

Student loan debt can leave a looming cloud over students’ mental well-being and financial security that only worsens once one graduates and has to begin repayment. Jeffrey Akers, a recent UK alumni, said that his concern about his student loans is prominent in his everyday life, especially in the COVID-19 pandemic.

“Student debt, while halted through the CARES act, only makes me realize more the impact it has on my life and so many others. The idea of making payment on 5 different loans makes me wonder how that will be possible with the cost of rent and wage I am currently at,” Akers said.

Biden signed an executive order extending the pause on student debt repayment through September 2021. Debtors will still owe their lump sum but not interest from passed months. Private loans are still in effect.

Akers said he also feels like the education system itself sets up a constant cycle of financial worry without enough benefit for students.

“You go to school full of hopes of a great paying job and end up two years out of school only to end up working for a low wage and something outside of your passion and purpose,” Akers said. “It is frustrating and confusing as to how an education that puts you this much in debt could possibly put us this far behind.”

Akers said that the $10,000 relief would mean that he could break away from this cycle.

“It would mean I could put $10,000 into my dreams, into my purpose. Since graduating, I have wanted to inspire people and motivate people to follow their dreams. Often too many people get distracted by the debt of education and settle for something less than what their dreams once were,” Akers said.

Isabel Phillips, a senior political science major, said that though she is still in school, any amount of student debt forgiveness would mean she could feel less anxious for post-graduation.

“If either of the reliefs were passed I would be much less stressed about how I am going to manage paying my loans off,” Phillips said. “I also think I would be able to be more risky when it comes to what career I want to pursue because I won’t have to be concerned about making enough money to pay off my loans.”

Emily Hall, senior kinesiology major, said she would feel the same sense of relief when it comes to any level of student debt forgiveness, but she would like to see more relief than Biden’s $10,000 plan.

“If $10,000 was forgiven I would view that as super helpful but only a kickstart. I would view $50,000 as more of a weight off my shoulders,” Hall said.

Hall said with interest payments adding up, the $50,000 relief would help ease her mind far more than the $10,000.

“Interest really builds up in student loans over the years that you are in college, so the loan I took out my freshman year has increased a lot,” Hall said. “I often stress of paying off my loans post-graduation. Each year when I have to pay my tuition it is a huge anxiety-causing event because I realize just how much it costs to have a college education.”

Hall was not alone in advocating for the $50,000 relief, as both Akers and Phillips were in favor of it as well.

It is unclear when action to forgive any amount of student debt will be taken, but Akers said he hopes to see some form of action soon not only for current students but for the future of our country.

“There is potential in all people when given the chance and opportunity, but sometimes that opportunity comes at a cost that is too great in the world of uncertainty. Education is vital to where our future takes us, I believe all people deserve that opportunity to learn, grow, and inspire others through their education,” Akers said.