Views of a Pledge: Saving up for the holidays

November 21, 2017

It’s that time again! What time, you may ask? The holidays, of course! Christmas is just over a month away.

But wait, how does a person buy Christmas gifts for their friends and family when they are “the broke college kid?”

Being in college has many financial expenses. There is the on-campus combination of tuition, student fees, and room and board to worry about. If you are living off campus, you have tuition, student fees, rent and bills to pay. If you are affiliated with Greek life, you also have pledge or active dues, which can run anywhere from $400 to $800 a semester.

By the time one budgets for those expenses, they will be nearly broke. Forget Christmas, they wouldn’t have money to live on.

Worry no more! Below are some helpful financial tips from Forbes.com to follow, tailored to be applicable to UK.

-

Get a job, but a flexible one.

There are jobs here at UK that are specifically for students. For example, you could apply for a library job at one of our libraries on campus. Supervisors are understanding when scheduling your shifts and often do it around your school schedule.

-

Learn to Start Saving a Little Each Month

Start by saving $5 a week for a month, then the next month, increase it to $10 a week. Continue to increase your weekly saving monthly by $5 (or by every two months or even a semester if you are really strapped for cash). If you do this, by next Christmas, you would have a lot saved up.

-

Be smart about recurring expenses like books

Never buy your textbooks at the campus bookstore; they will cost you a lot of money. Websites like Amazon.com and TextbookRush.com offer the same textbooks you would normally buy at the bookstore, but at a lower cost. For example, I needed a book for one of my classes. The bookstore was going to charge me $15 for it, but instead I went to Amazon.com where the same book was just $1.

-

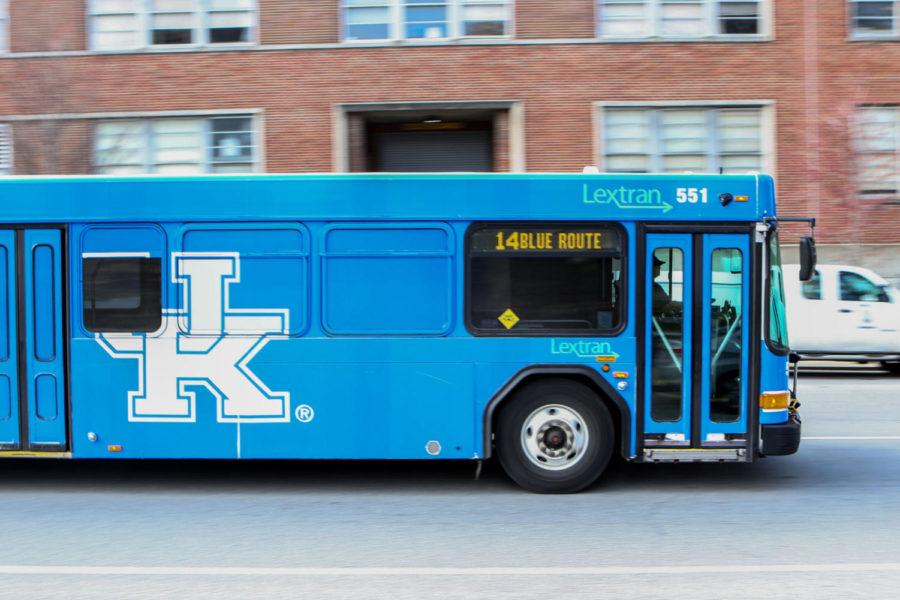

Ditch the Car and Use Public Transportation or Ride Sharing

Forget buying that parking pass. You can ride the Lextran buses around the city for free. Just show your student ID to the driver. If you need to get somewhere in a hurry, take an Uber or a Lyft. They are usually not too expensive unless you are going very far. If you have a few hundred dollars, you could also invest in a moped. Mopeds save money on both parking passes and gas.

And finally, a personal tip from me, which is separating needs from wants. What I mean by this is do you have to have a cup of coffee from Starbucks every morning? If you would buy a coffee maker and start using it instead of buying Starbucks often, you could save a whole lot of money. If you absolutely love Starbucks and can’t live without it, cut your Starbucks consumption to once or twice a week. Trust me, the Starbucks coffee will taste better if you don’t drink it so often.

With these tips, you will be able to afford buying gifts for your family and friends for Christmas.