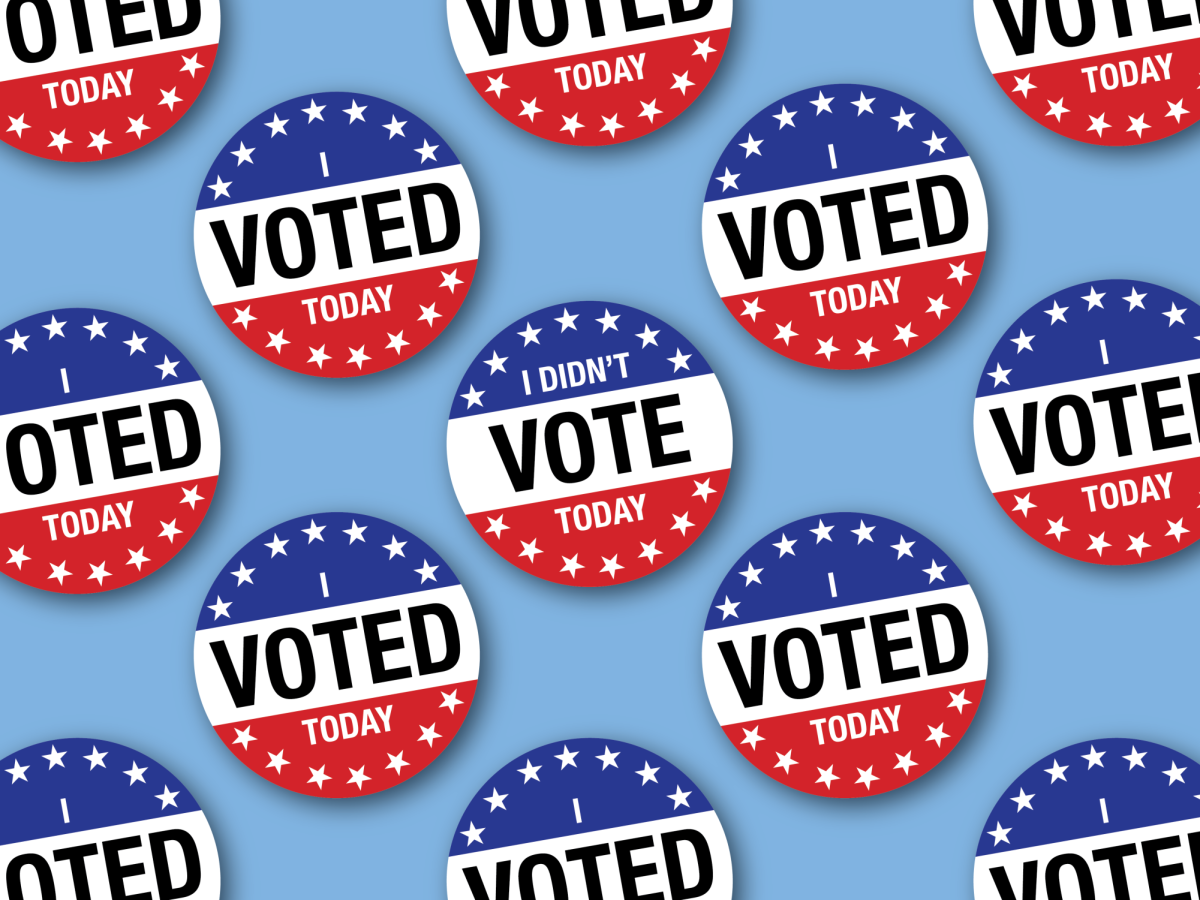

Seven Central Kentucky locations hit with credit card skimmers between September, November

March 30, 2016

UK students and Lexington residents should use caution when paying at the pumps and hitting up the ATM, as Kentucky has seen an increase in credit card skimmers in the last four years.

Two ATMs and two gas stations in Central Kentucky have been hit with skimming devices so far in 2016. No skimming devices have been reported in Lexington this year, but seven were reported in Central Kentucky between last September and October. Two of those cases were in Lexington.

According to Detective Michael Helsby of the Lexington Police Department’s Financial Crimes Unit, Lexington has seen an increase in cases of such devices since the Target credit card breach in 2012 that leaked credit card information for about 40 million people.

A credit card skimming device can be placed in an ATM or inside a credit card slot at a gas station pump. When a customer inserts the card, the device captures the lines of data stored in the magnetic strip on the credit card, and stores it on flash memory.

When the suspects come back and retrieve the devices, they have access to information from all the cards that have been used and can make duplicate credit cards.

From there, the suspects can go to an ATM and withdraw cash directly form the cardholder’s account. ATM skimmers can be purchased online, but possessing one in Kentucky can lead an individual to be charged with possession of a forgery device.

The gas pump skimmers, Helsby said, are created by individuals with “a little bit of electronics know-how.”

“If you knew your way around a gas pump, they’re not very difficult to make and install,” Helsby said.

The crime is typically committed by groups moving in and out of the area, explaining why they happen sporadically yet in a condensed period of time, according to Helsby. He said the group was more than likely from outside Kentucky, and possibly from outside the country.

Helsby suggested that UK students and Lexington residents look for cut or obstructed security tape on gas station pumps and ATMs, as this is a sign that a skimming device has been placed, since the hacker would need to cut the tape to access the inside of the machine.

“The employees are supposed to check that tape and see if it has been tampered with,” Helsby said.

He also said residents should regularly check their bank accounts for irregular transactions.

Helsby said for each ATM that was hit during the period from September to November, the banks reported losses between $50,000 and $70,000 per skimmer.

Helsby could not release the names and locations of the businesses or individuals who were affected during the period in 2015. He passes along information to the U.S. Secret Service, which investigates cases of credit card theft and fraud.

No arrests have been made in any of the cases, but Helsby said police have a lead suggesting the suspects could be an eight-person group out of Texas, though this is unconfirmed.