UK’s finances boom despite budget cuts

April 10, 2016

Although UK is right to complain about imminent cuts to state appropriations, the university is in a strong financial position. Any businessman would love to lead a place like UK, where a massive team of analysts have ensured increased assets, diversified revenue and improved credit ratings — which makes UK the fiscal leader among Kentucky universities.

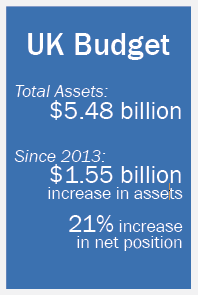

According to UK’s 2015 Financial Statements, total assets for the university were $5.48 billion as of June 30, 2015. This is an increase from $3.94 billion in 2013.

Net position, taking into account both assets and liabilities, has increased by about 21 percent – almost $600 million – since 2013.

UK’s operating budget has also grown steadily in recent years. However, the budget still runs negative without the addition of state appropriations, gifts and grants.

But UK has been relying much less on state appropriations in recent years. In fact, appropriations could have been cut 44 percent in 2015, and UK still would have seen the same increase in net position as in 2013 – about $190 million.

In a discussion about the statements, UK management said that they expect state appropriations to make up a smaller percent of the budget in the coming years. UK seems to have compensated for this, since removing all $280 million in state appropriations from the picture in 2015 would have resulted in a positive return.

How has UK found so much success in the past couple years? The main driving factors were public-private partnerships and health care revenue.

Since President Eli Capilouto came to UK, the university has made three high-profile and profitable partnerships with EdR (for housing), Aramark (for dining), and Barnes & Noble (for the campus bookstore).

But the main driver for the increase in revenue in the past two years was UK’s hospital services. The financial statements attribute this increase to higher rates and a wider patient base.

Because of UK’s financial successes in recent years, it has been rewarded with improved credit ratings from S&P and Moody, two of the largest credit agencies. Both agencies cited UK’s revenue diversity with UK HealthCare and increased tuition revenue as positive factors in their decision.

The office of the Executive Vice President for Finance and Administration should be credited for much of this financial improvement. This group, listed under Finances and Administration in the UK 2015 Operating Budget, takes home about $130 million per year. As a caveat, not everyone under this listing is strictly a finance and administration cost, nor are all finance and administration personnel accounted for here.

In a brief summary in the statements, UK management said, “Management believes the University will be able to sustain its sound financial position and continue its progress toward becoming a nationally recognized public research institution.”

Email opinions@kykernel.com