Personal finance classes in college

May 31, 2017

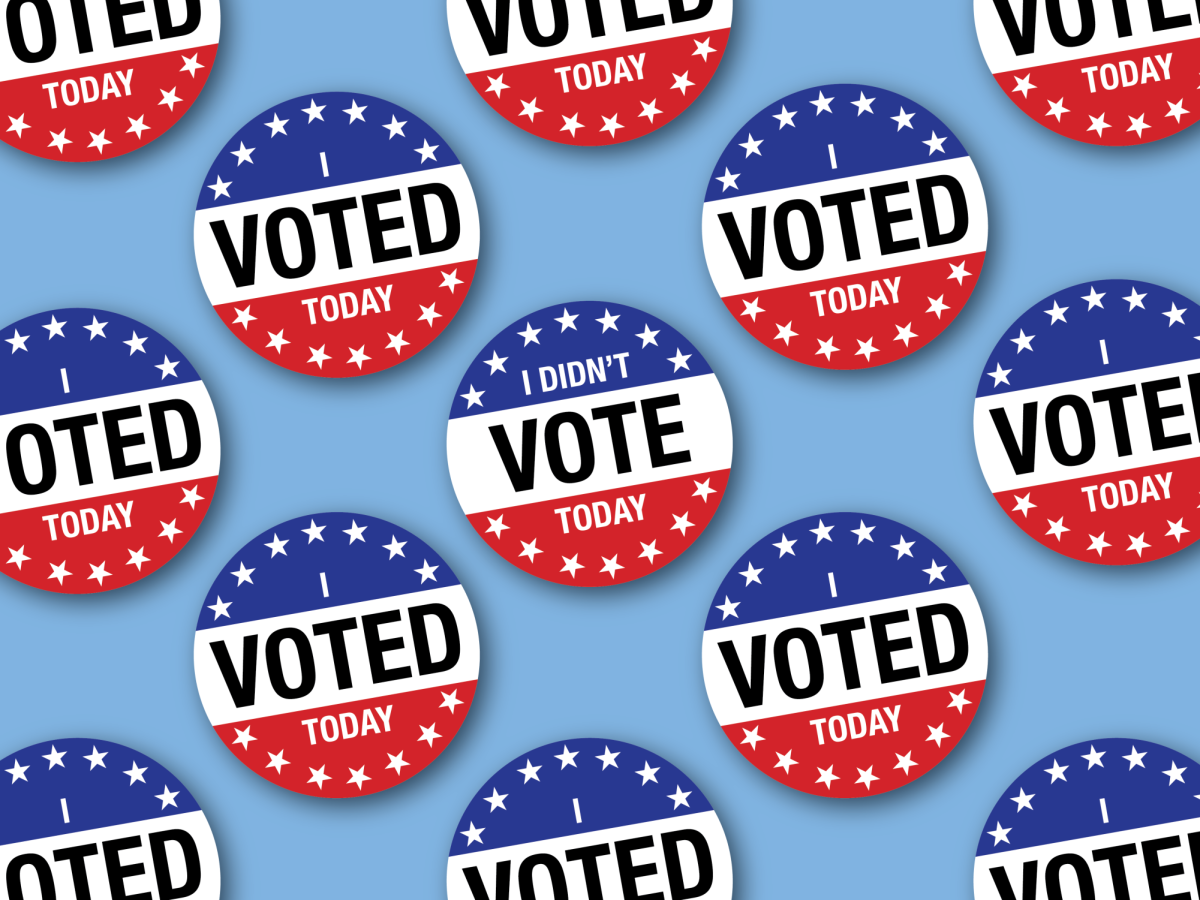

Should colleges require students to take personal finance classes? That is the question among educators as student loans and debt are a bigger issue than ever. But are personal finance classes the answer?

In 2015, the U.S. ranked 14th in a global study measuring the financial literacy of each country. The financial literacy rate in the U.S. was 57 percent.

Only five states require a personal finance course in high school and 20 require an economics course. By age 40, only 1 in 3 Americans can understand and apply important financial concepts, often after they’ve already made huge financial life decisions. When it comes to student loans, more than half of millennials apply for student loans without trying to calculate what their payments will be or how they will repay them.

Some educators believe that personal finance classes will equip students with the tools they need to understand basic financial concepts and apply financial plans that will help them thrive. Others argue, however, that personal finance courses alone won’t be able to give the common citizen the knowledge of financial products and tricks that are necessary for success. On either side, though, financial skepticism is the best skill one can practice.

To read the full article in The Wall Street Journal, click here.