Tips for Surviving the First 5 Years of Small Business Ownership

May 18, 2021

(StatePoint) What motivates entrepreneurs to become self-employed? How do they measure success? What’s their cutoff for profitability and self-reflection on status? A new survey examining these very questions provides important insights to small business owners and those looking to start their entrepreneurial journey.

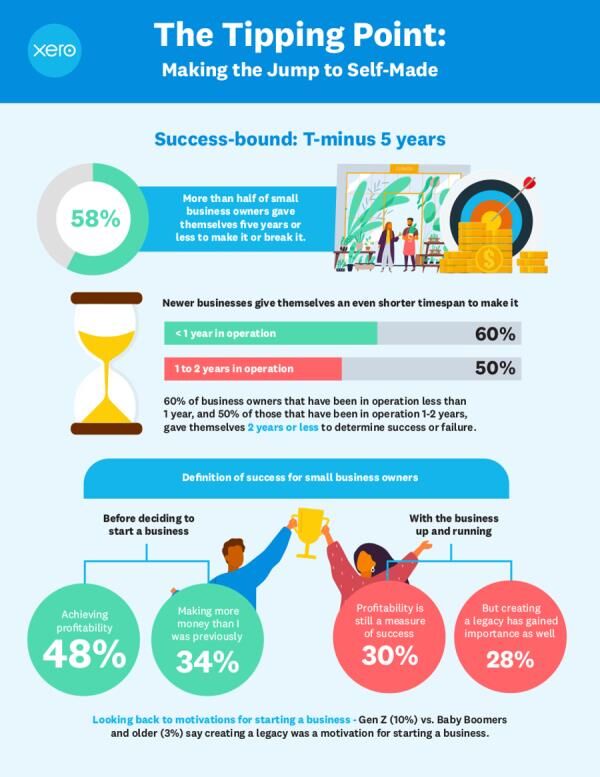

“The Tipping Point: Making the Jump to Self-Made” report from global small business platform Xero surveyed 1,200 small business owners nationwide and, among respondents, 58% gave themselves five years or less to make it or break it – with newer businesses giving themselves an even shorter timespan on average. Here are some of the survey’s key findings, along with tips for surviving your first five years of small business ownership:

1. Define what success looks like: When they made the move to branch out on their own, 48% of small business owners defined success as achieving profitability, and 34% defined it as making more money than they were previously. Fast forward to the present with their businesses up and running and 28% of business owners cite creating a legacy as their success measure. Having tangible and intangible benchmarks of achievement can help you stay focused.

2. Know your “why”: According to the survey, one of the strongest motivators for starting a small business is the belief that it provides greater flexibility and control when you’re your own boss (45%). Passion/purpose in work (28%) and financial reasons (15%) were also strong motivators. Running a business can be tremendously satisfying when you understand what your “tipping point” was for taking a leap of faith and venturing out on your own.

3. Be flexible: Twenty-nine percent of small business owners say the pandemic has increased their desire to run a business, particularly among younger business owners (43% of Gen Z vs. 18% of Boomers) and women (34% of women vs. 24% of men). But what do those businesses that thrived in the COVID-19 era have in common?

“The majority of newer businesses have been set up on technology platforms and digitally enabled since their inception,” says Ben Richmond, US country manager for Xero. “They’re ready for and in many cases even expecting disruption, so they’ve established afoundation that’s open to pivots.”

4. Be realistic: While most business owners say they started their business for increased flexibility and control, being the boss doesn’t equate to less stress. In fact, that’s the biggest misconception about starting a business (47%). Another top misconception is that starting a business will be more fun than working for someone else (25%). Understanding the realities of entrepreneurship can help you avoid surprises, and ensure comfort in the role as it changes.

5. Lean on digital tools: When you’re a small business owner, it can often seem like there are never enough hours in the day. Using software that streamlines the nitty-gritty can free your time so it’s better spent on the big picture. For example, the cloud-based accounting software platform Xero gives small business owners and their advisors access to real-time financial data on any device. Its 2.45 million subscribers are leveraging its array of tools that simplify tasks like paying bills, payroll, claiming expenses and sending invoices.

To view the full report and for more information, visit xero.com.

“It’s certainly been an unusual year for business, but entrepreneurs are generally feeling positive about the economic outlook in the months ahead. For enterprises still in the make-it-or-break-it period, that’s especially good news,” says Richmond.