New student loan forgiveness policy sparks varying responses from UK students and alumni

A student studies in the William T. Young Library on Monday, Aug. 17, 2020, at the University of Kentucky in Lexington, Kentucky. Photo by Michael Clubb | Staff

September 5, 2022

President Joe Biden announced Aug. 24 that the federal government would forgive $20,000 in student loans for borrowers who received Pell Grants and make less than $125,000 per year. Borrowers who did not receive Pell Grants but still fall within this income bracket are eligible to have $10,000 of their loans forgiven.

Reactions to this announcement have been mixed across the country, and UK’s current and former students are no exception. Some appreciate the benefits, while others are more concerned about long-term effects on the economy and the government’s actions.

‘Advantageous’ but still ‘surprise legislation’

Second-year dental student Jonathan Wheeler described himself as “financially aware” in his undergraduate career.

A chemical engineering major, he became involved in MoneyCATS, UK’s financial wellness peer mentoring program, his sophomore year. He funded his education through a combination of subsidized loans, scholarships, and private donations, as well as receiving a Pell Grant.

Wheeler said he does not think the loan forgiveness program is a “great policy” but said it was still “advantageous” for him and his wife.

“With us combined, we’ll end up with around $40,000 in forgiveness, so that’s very nice,” he said. “That’s something we won’t have to worry about paying off right after I graduate.”

However, Wheeler said he is concerned about the ramifications of this “surprise legislation.”

“Even Congress didn’t exactly know how to react because they didn’t have any role in it,” he said. “[The total forgiven loans] will probably end up being like 400 or 500 million dollars when all is said and done. I don’t know how that’ll impact inflation. I don’t know how that will impact a lot of things, and really no one does at this point.”

Wheeler also said this policy might make new students more willing to put themselves in debt and cause further financial complications. Overall, though, he still sees the benefits the program is bringing.

“If you don’t really know how loans work, I think after this, it would be very easy to just hope that the federal government would bail everyone out again,” he said. “I think it’ll be nice for a lot of people. I’m happy that I’m one of the people who it’ll be nice for. I just hope that everything works out okay in the long run.”

‘We’re not fixing the problem’

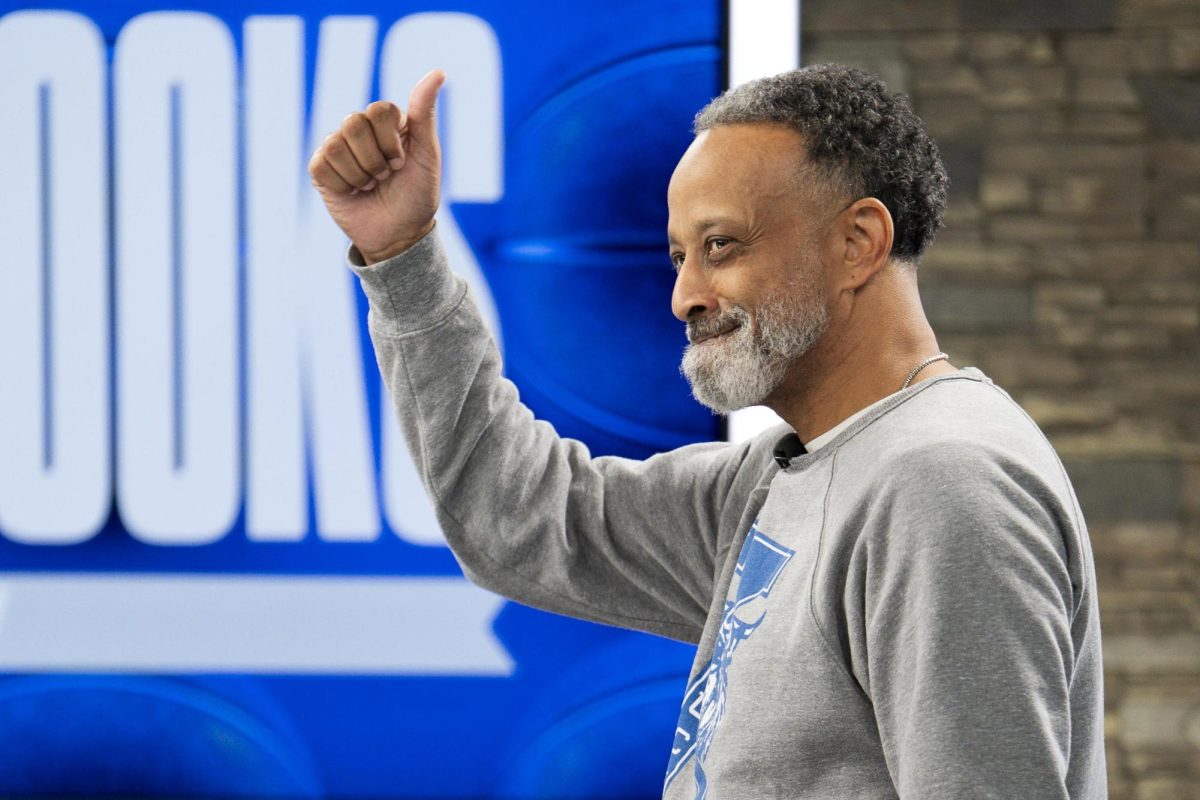

David Burnett graduated from UK’s Gatton College of Business in 2009 and the College of Nursing in 2015. When he heard that loan forgiveness policies were most likely in the works, he made sure to pay off all his student loans – over $10,000 – before any policies went into effect.

“I was able to earn the money because I had worked as an ICU nurse taking care of COVID patients four days a week while finishing law school in Detroit,” Burnett said. “This is my debt. I assume this debt. I’m earning money off of this debt as a nurse, and I should pay off my loans.”

Burnett had heard discussion of loan forgiveness policies before they were announced, even viewing repeatedly extended loan payment pauses as a precursor. Still, he was uncertain about how these policies would work, viewing them as an overstep of executive power.

“I think procedurally, the way these things are done matters. Article One, Section Eight of the Constitution [says] the spending powers are Congress’s and not the president’s. But clearly, that’s taken a different direction,” he said. “I didn’t want to be on both sides of that transaction.”

After graduating, Burnett became a travel nurse before going to law school. Currently, he works as an attorney in Harrisburg, Pennsylvania.

Burnett said he finds it “silly” that elite college graduates like himself are eligible for the program, while lower-income people who do not have student loans will be footing the bill as taxpayers to address this now-federal debt.

“It’s a transfer of wealth from the lower class to the upper class elites … Those [high-income] people still qualify for the loan payoffs, and those are coming from the taxpayers. And the taxpayers include the plumbers, the EMTs, the 911 dispatchers, the truckers [and] the electricians,” he said. “I know these people. Some of them are clients; many of them are friends. They’re not happy that they’re having to pay off the loans for these definitionally elite college graduates.”

In a similar argument to those presented by policy experts, Burnett is also concerned about the effect these policies will have on inflation.

“This is injecting, according to some estimates, between 300 and 400 billion dollars into an already inflated, overheated economy,” he said. “The stock market is crashing today because the [Federal Reserve] is going to have to continue to raise interest rates to keep people from spending money. Now these people have more money to spend, so we’re counteracting our own influence. All of this seems galactically incompetent to me.”

Burnett also touched on his experience as a nurse and the disconnect he has between government statements and reality. Despite the government using the COVID-19 pandemic and its resulting public health emergency to justify policy changes, he said, the emergency itself is decreasing in severity.

“Having worked in COVID ICU and seen a significant amount of deaths from COVID, I think there was an argument in favor of that public health emergency, and I think good things came out of it … [but] two and a half years later, we’ve got multiple different kinds of vaccines, and the death rates have fallen to very minimal amounts. I’m not sure there’s a rational argument for there still being a public health emergency,” Burnett said. “Unfortunately, it seems like nothing is more permanent than a temporary government policy. And that’s why I’m concerned about emergency powers period being used in this way.”

Burnett said he hopes the policy is taken to the Supreme Court and overturned.

“I think it’s government overreach, and it’s certainly presidential overreach,” he said. “I don’t know that it’ll happen again. I don’t think it should happen again. I don’t think it should have happened in the first place.”

‘A holistic view’

With a PhD in molecular biology and biochemistry, Dr. Bradlee Heckmann knows firsthand how expensive professional degrees can be.

“When I was an undergraduate student at UK, I had student loans that I had to take out and, of course, being in a professional degree program, you know, that gets expensive,” Heckmann said. “Most of the people that I know would have some level of student loans.”

Heckmann graduated from UK in 2011 with a bachelor’s degree in biology, completing further training at the Mayo Clinic College of Medicine. Currently, he works at the Byrd Alzheimer’s Center at the University of South Florida.

Heckmann said he “see[s] both sides” of the debate over student loan forgiveness. He said he views the new policy as a way for students to better reward themselves for the work they put in through college.

He also tied it to his own experience in medical programs, saying that people in scientific careers typically do not make significantly high incomes until 10 to 15 years after they graduate.

“It can be so detrimental to a student that is so excited [that] they just graduated, and now they can’t buy a house because of their student loan payment,” he said. “That’s a struggle, right? When you’re getting paid, you know, 30,000 to 40,000 dollars a year, and you have crushing student loan debt … that can be challenging. So … there’s a nice gesture to those that have student loans and haven’t paid them off.”

However, Heckmann also said he understands those who are frustrated by the program.

“Those that have either not had to take out student loans or have taken them out and paid them off already, they don’t benefit from this legislation,” he said. “It’s a holistic view. When you look at this, there’s multiple aspects that are both positive and negative.”

Heckmann explained that this holistic approach can help people understand the general economic system that led to massive student loan debt in the first place. He said that interest rates on student loans are as high as interest rates on credit cards, knowing people who have taken out student loans with interest rates over 20%.

Heckmann also described that over his collegiate and professional career, salaries in Kentucky have not increased at the same rate as Kentucky tuition.

“That is not fair to students who are trying to get their way through college to get an education to better themselves in their future family and status in life and contribute to society,” he said.

If this policy had been announced when Heckmann was a student, he said, he would have seen it as “absolutely deserved.” However, he also said his views have changed as he matured, and especially in his position at USF, he now sees how student loans can be beneficial to higher education institutions.

“Universities … have a tendency to say we want to provide better resources [and] educational activities to students. But that comes at a cost, and of course, we get our costs from either state tax dollars if you’re a public university like USF and University of Kentucky, as well as through actual tuition,” he said. “There’s this fine balance [between] being able to provide the resources and the aspects necessary for a robust education … [and] being able to have that education attainable to the students that really want to go. I think that’s something that we have to consider for the future.”