The true cost of education

October 19, 2016

For some, college is what they’ve worked for since day one. Forget the price, location or sports team, all that matters is the education they sweat and lose sleep for. In today’s world, that education may cost a lifetime of debt.

Many people have student loans, especially out of-state students here at Kentucky who have to pay a higher amount than in-state students.

While loans might be easy to grant and receive, each loan comes with an interest rate that also must be paid off.

According to the Office of the Department of Education, as of 2016, “subsidized and unsubsidized loans are federal student loans for eligible students to help cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school.”

Related: Left side, strong side

For direct subsidized and unsubsidized loans, the current interest rates are 4.29 percent.

While this doesn’t sound like much to begin with, over time interest might be the only thing you can afford to pay off. For graduate or professional school, the interest rate is even higher at 5.84 percent.

These days, unfortunately, student debt has now grown to over $1 trillion in the United States, according to Forbes. Goldman Sachs projects that, “2015 graduates won’t break even until age 31, 2030 graduates won’t break even until age 33, 2050 graduates won’t break even until age 37.”

This is just the statistics for the students. What about their parents? College costs so much for the entire family, but many would agree college is worth the second job mom or dad might have to pick up.

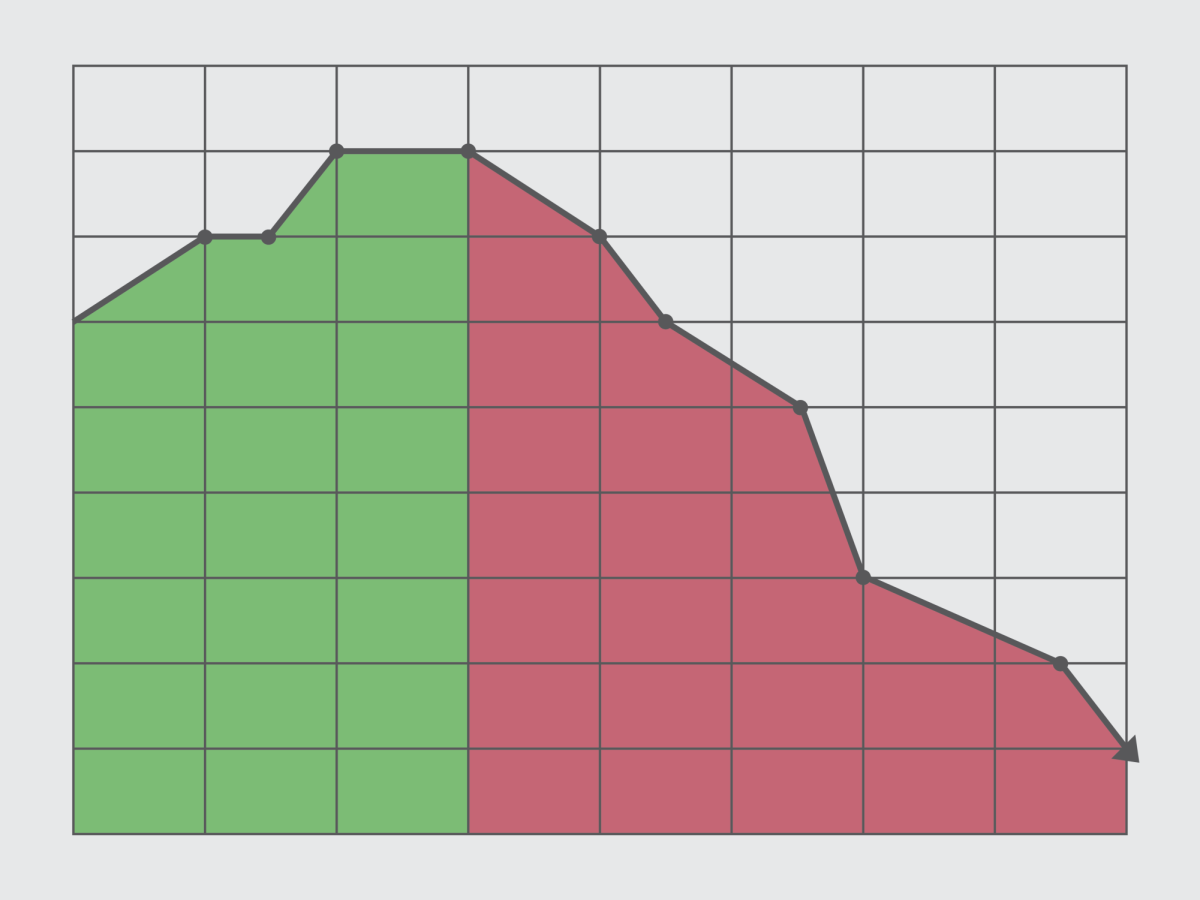

A recent survey from Gallup and Purdue University saw a huge agreement from college graduates that a college education is worth it. The pay gap between high school graduates and college graduates continues to increase, making it harder to get a decent paying job with just a high school degree.

Related: Bring back sex education

High school graduates today can earn up to 62 percent of the pay of a college graduate. In 1977 it was 77 percent. It is due to a lack of economic opportunity and growth for high school graduates, not because they are earning that much more.

Maybe college is only worth it depending on the major one picks.

According to CNN, “Graduates studying lower paying majors such as arts, education and psychology face the highest risk of a negative return. For them, college may not increasingly be worth it.”

While passion is important when picking a major in college, the decision is often wrought with concern for one’s financial viability.

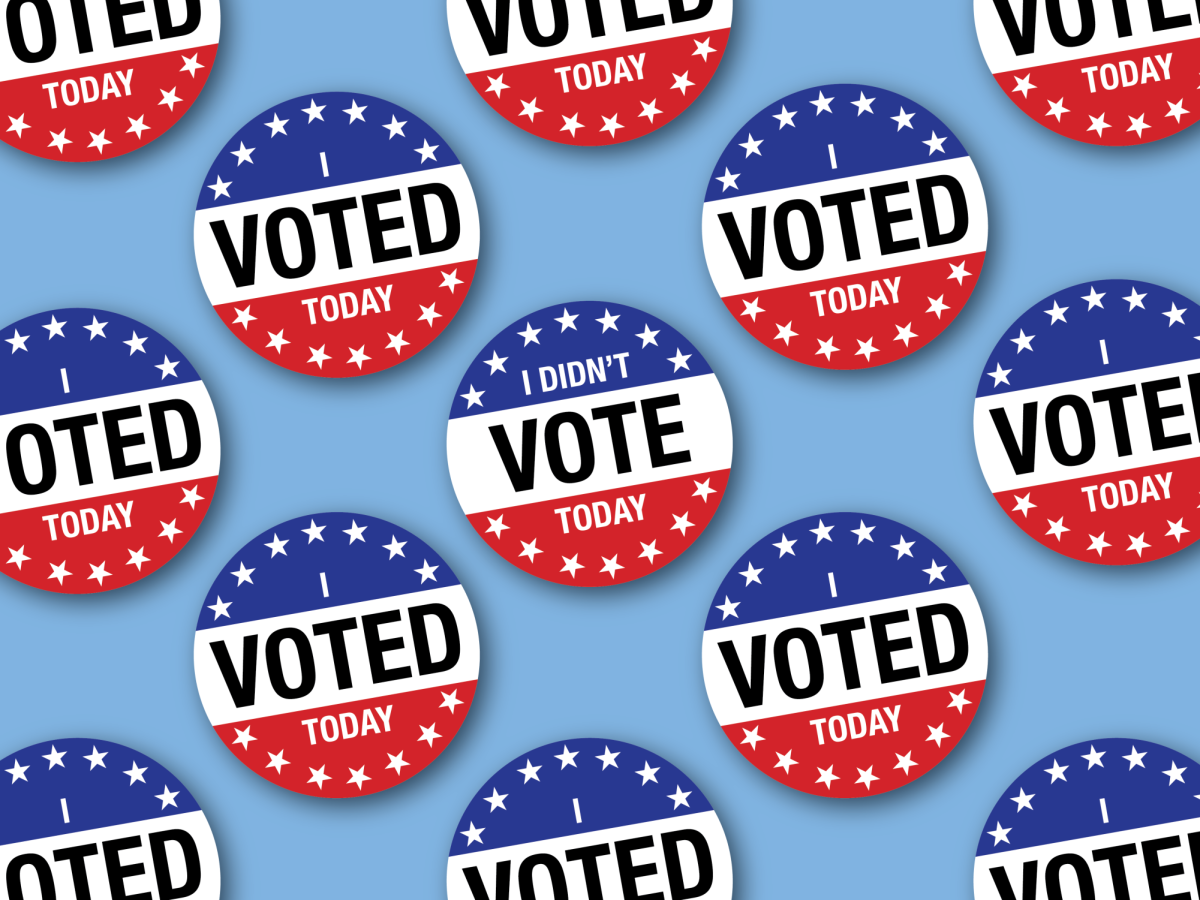

With the current election, it is important to keep student debt in the discussion.

College is more than just education, but a lifetime of memories. It provides social, organizational and time management skills.

It is important that students at UK understand how lucky they are to be here. Who knows how expensive this institution will become in the near future.

Email opinions@kykernel.com