Why cutting corporate taxes will not lead to America’s economic growth

November 17, 2017

After failing to repeal Obamacare, Republicans in Congress have set their sights on an issue they believe is a sure win: tax reform.

Republicans have introduced a tax reform bill, both in the House and Senate. While many are supportive of tax reform in general, there are parts to it that are causing much upheaval and skepticism within and outside the party.

The bill addresses many different aspects of the tax system, but the component receiving the most attention is the proposal to permanently cut corporate taxes from 35 percent to a proposed 20 percent. What is the reason for this tax cut? Republicans argue that cutting taxes leads to economic growth, giving more money back to corporations so that they can pay their workers a higher wage. Essentially, it’s an argument for trickle-down-economics.

However, this plan operates on a flawed assumption. It assumes that corporations will take the money that they would’ve paid in taxes and invest it in their frontline workers. This simply isn’t the case. Corporations would have the public believe that they aren’t paying their workers more because their profits are too heavily taxed to allow for it.

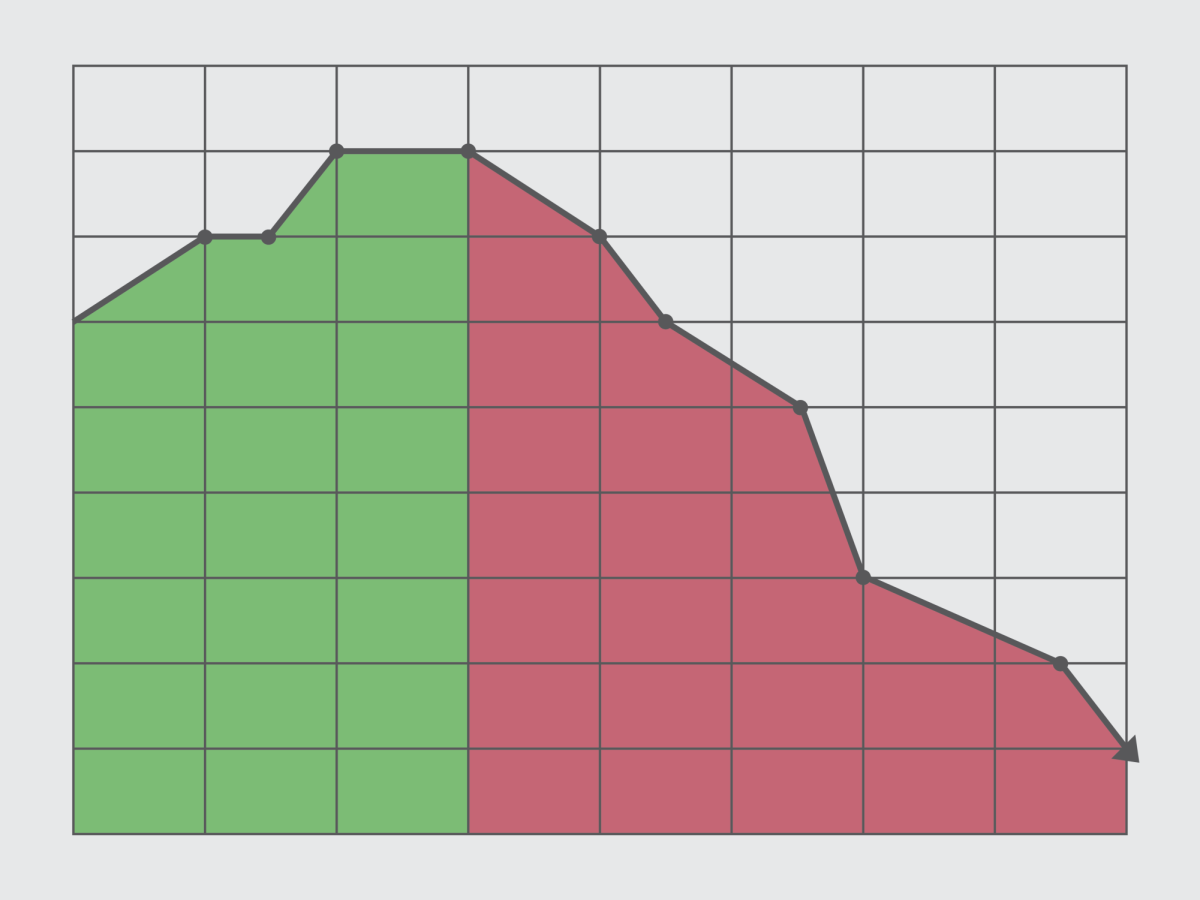

In reality, the corporate tax rate is the lowest it has been since the 1950’s and in 2013, made up only 10 percent of the federal revenue tax. Meanwhile, corporate profits are sitting at a record high, and yet workers’ real wages (adjusted for inflation) have remained stagnant, some even falling since the 1960’s, according to the Pew Research Center. During this time, CEO pay in America has risen 997 percent. Income inequality has skyrocketed in America, with the top one percent controlling 38.6 percent of the country’s wealth, according to the Washington Post. The new tax bill would only make it worse.

So the argument that cutting taxes will increase wages is completely unsupported by facts. It is an assumption built on a broken economic theory. History shows us that as profits in corporations rise, CEOs move to pad their pocketbooks first. Then they look to split the rest between their shareholders. The money exempt from corporate taxes will not benefit the middle or lower classes. They will continue to make the same wage, while the elite earn more and more.

Not only is cutting corporate taxes not logical, but it is not popular. Fifty-two percent of Americans are in favor of raising corporate taxes compared to slashing them according to the Pew Research Center. The American people don’t want this version of tax reform, and it will not help a majority of Americans.

The plan is insensitive and out of touch, and it is not clear in what form the bill will be passed if it makes it that far. However, one thing is understood. The tax reform bill has been created with a mountain of assumptions that are not rooted in truth. There is no data to prove that tax cuts lead to economic growth. The GOP is seeing the bill through rose-colored glasses. While the tax bill may help corporations and their bottom lines, it will negatively impact most Americans.