Class offers basics on budgeting, investing

April 3, 2013

By Andrea Richard | @KyKernel

The reason most young adults know so little about finances is because most high schools do not require students to take a personal finance class, according to a US News article.

However, a poll conducted by Sallie Mae in 2012 found that 84 percent of high school students want to be financially educated.

For students interested in becoming financially literate, UK has a solution.

In fall 2013, UK will offer a course, FIN 250, on personal investing.

Finance 250 is for any student who wants to gain an understanding of how to invest and the importance of investing.

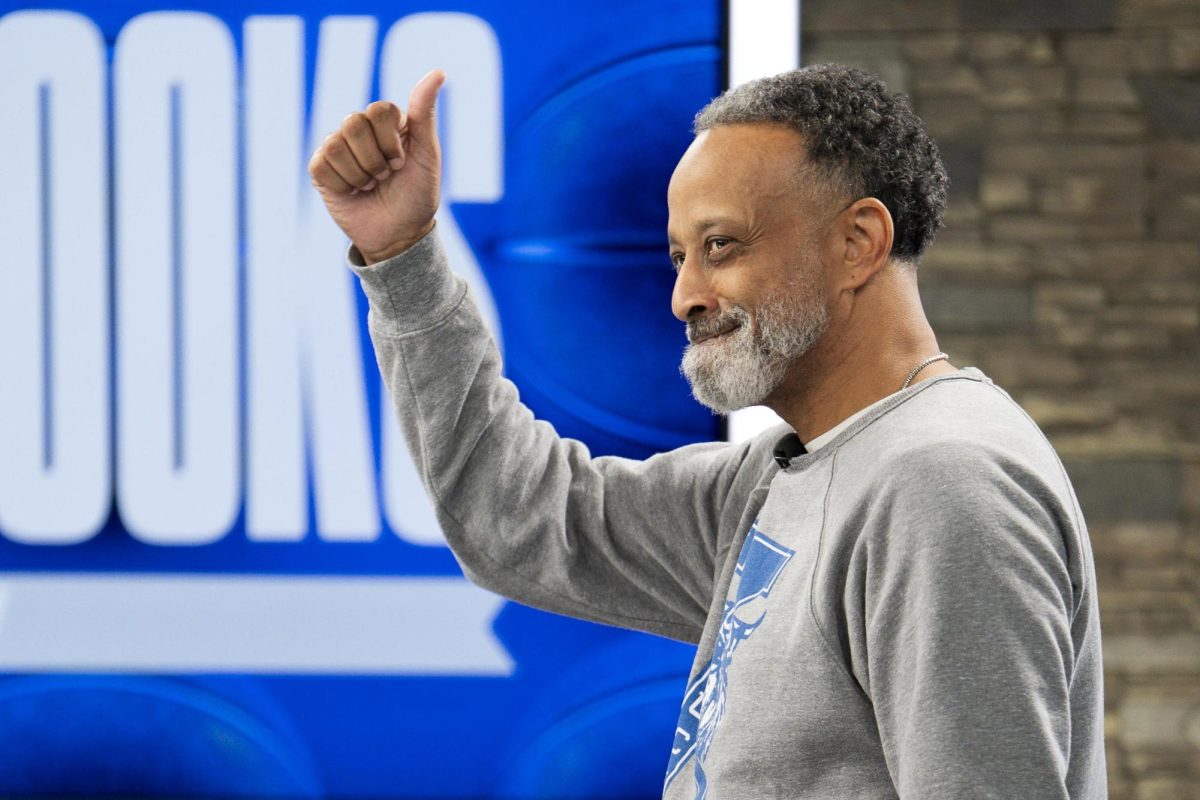

The class will be taught by Paul Childs, an associate professor of finance and quantitative methods.

According to Childs, the class will teach students about stocks and bonds, mutual funds and retirement investing.

The class also will cover personal savings accounts and various ways to increase income.

College students might not realize that the interest rate for the average savings account is below 1 percent, according to Ally Bank.

Because of this low interest rate, Alice Bonaime, an assistant professor of finance and quantitative methods, recommends using a savings account as an emergency fund for unexpected expenses.

Once a student has enough money saved for emergencies, Bonaime suggests using additional money to start paying off debt.

Students should always start paying on the debt with the highest interest rate, Bonaime said. For those who are lucky enough not to have debt, a savings account is good for achieving short-term financial goals, like saving up for a down payment on a car.

For students who have money saved and do not need that money to pay bills, Bradford Jordan, chair of the Department of Finance and Quantitative Methods, said opening up a Roth IRA account is a good idea.

A Roth IRA account is a retirement-type account.

“The money you put in grows tax-free forever,” Jordan said. “It’s the best savings vehicle in the world.”

Since a Roth IRA is a retirement account, you don’t want to take money out once you put it in. However, you can access the money in a Roth IRA without penalties for a limited number of situations, such as paying for an education.

A Roth IRA account can be opened with as little as $250. The best place to open an account is at a mutual fund family like Fidelity.

“Once you have a Roth IRA at a big mutual fund family, you’ll have access to the entire menu of options the mutual fund family offers. The best investment in a Roth IRA for young people is what is known as an index fund,” Jordan said.

Index funds are all stocks, so there is no interest.

A money market fund is another short-term savings investment option for students. Generally investments of one year or less, money market funds are high quality, liquid securities.

“If you have money you think you may need at some point in the near future then that’s where you should put it,” Jordan said.

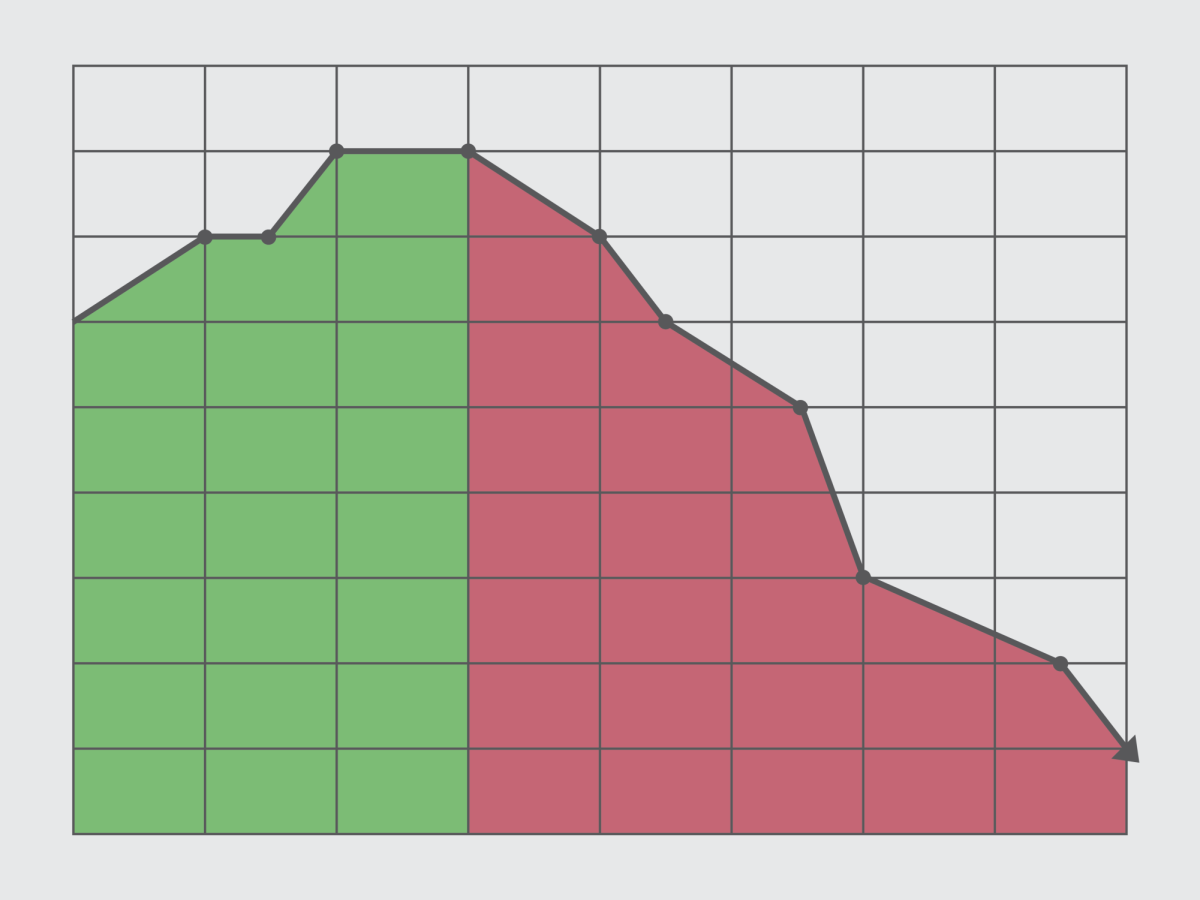

For students who want to grow their investment, CDs (certificates of deposit) and treasuries are sound options. The interest on these securities depends on two factors: how long one is willing to lock up money and the risk.

Bonaime compared the interest on a one-year CD versus the interest on a five-year CD. The interest on a one-year CD might pay around .45 percent while the interest on a five-year CD could be around 1.4 percent.

Bonds are another investment vehicle, but they are associated with more risk. Government bonds carry lower rates and lower risks. Corporate bonds maintain higher rates but are more risky.

Finance 250 does not have prerequisites.

“It is a class that every student needs to take,” Bradford said.