7 Ways to Pay Less on Auto Insurance

7 Ways to Pay Less on Auto Insurance

March 23, 2022

(StatePoint) Inflation is driving rising costs on everything from gasoline to groceries. And recent research shows that auto insurance is expected to rise for most policyholders this year too. While you can’t control how insurers price their policies, you can avoid shouldering higher costs.

Here are a few ways to directly reduce your car insurance rates or mitigate increases:

• Reduce coverage. Look at your insurance policy to see if you could forego any add-ons, such as roadside assistance. If you have an older vehicle, consider all your options to see if paying for collision and comprehensive coverage is worth it.

• Increase your deductible. You may be able to lower your insurance premium by choosing an increased deductible (the amount you spend for repairs before insurance kicks in). Although increasing your deductible could save you money now, it could result in you paying more out of pocket if you have an accident down the line.

• Use driver tracking programs. Insurers typically base your premium on the information you provide them that indicates the level of risk they take on by insuring you. By using a driver tracking program, you’ll provide your insurer additional information on your driving habits, which—if you are a careful and safe driver—could reduce your cost by 25% or more.

• Check for discounts. Depending on where you are in life, you may be eligible for new savings opportunities like senior/retirement or good student discounts. Ask your insurer about the various discounts you may be eligible for to see how you can save even more on your premium.

• Compare quotes. Comparing quotes from different insurance providers can help you save money and lock in the best possible deal. Using price comparison websites can help simplify this process, allowing you to compare personalized quotes from multiple providers in real time. For example, Experian’s auto insurance comparison service leverages technology to compare quotes from over 40 top providers in minutes. Its average user saves more than $900 on auto insurance each year. Plus, the service offers free active rate monitoring, scouring the market on an ongoing basis to make sure you are getting the best rate among the Experian network of providers.

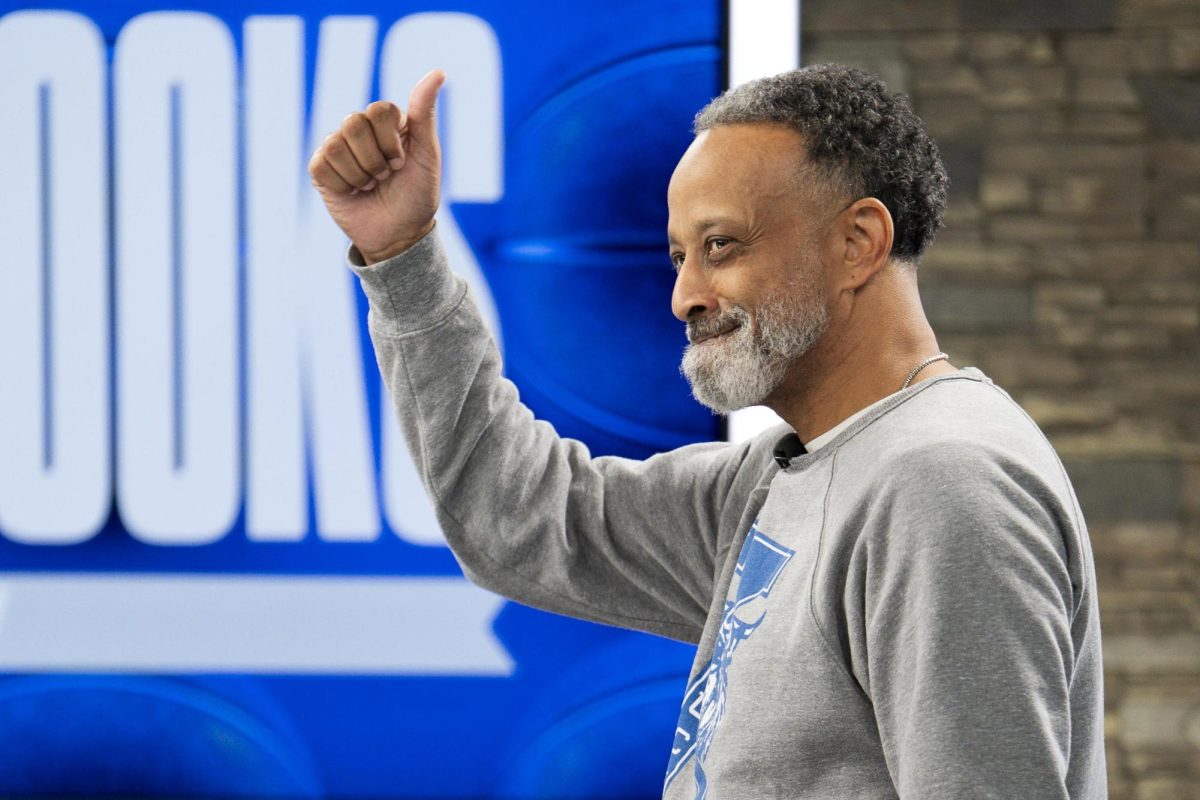

“Right now, consumers are looking for ways to maximize their budget. Our tool allows them to do in minutes what used to take hours, as well as possibly save hundreds of dollars,” says Rod Griffin, Sr. director of Public Education at Experian.

To learn more, visit www.experian.com/save.

• Improve your credit score. Some insurers consider your credit-based insurance score when determining your premium. These scores use information in your credit reports to look at the likelihood that you’ll file a claim so insurers can raise or lower your rates accordingly. To find out where you stand, you can check your credit report and score for free. Think about using services like Experian Boost to add positive payment history for utility and telecom accounts as well as video streaming services to your Experian credit report, which can potentially increase your FICO Score in real time.

• Pay off your loan. If you’re still paying off your current vehicle, your lienholder may require that you hold a higher level of insurance, such as comprehensive and collision. If manageable, paying off the loan could help you eliminate extra coverage expenses from your policy—lowering your monthly insurance payment.

With inflation and interest rates on the rise, finding savings on big-ticket costs like auto insurance could make a significant impact on your budget. Fortunately, new tools and smart strategies can help you save.

Photo Credit: (c) iTref / iStock via Getty Images Plus