Insurance companies need to provide mental health coverage

November 8, 2017

One in five adults suffers from a mental illness in the U.S. That’s over 40 million Americans; and 56 percent of those adults did not receive treatment, according to Mental Health America.

Why? One of the main factors is because it is expensive, regardless of if someone has insurance or not. Insurance companies are not required to provide mental health benefits, unlike physical injury coverage.

In 2008, the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act passed. It requires insurance companies to provide coverage of mental health services, behavioral health and substance abuse disorders, and for those services to be comparable to the physical health coverage that company provides. However, the parity law, which differs by state, doesn’t require insurers to provide mental health coverage, if they did not previously offer it before the law was passed.

Another problem is “prior authorization,” which requires a physician to obtain approval from the patient’s insurance company to provide a certain care or medication.

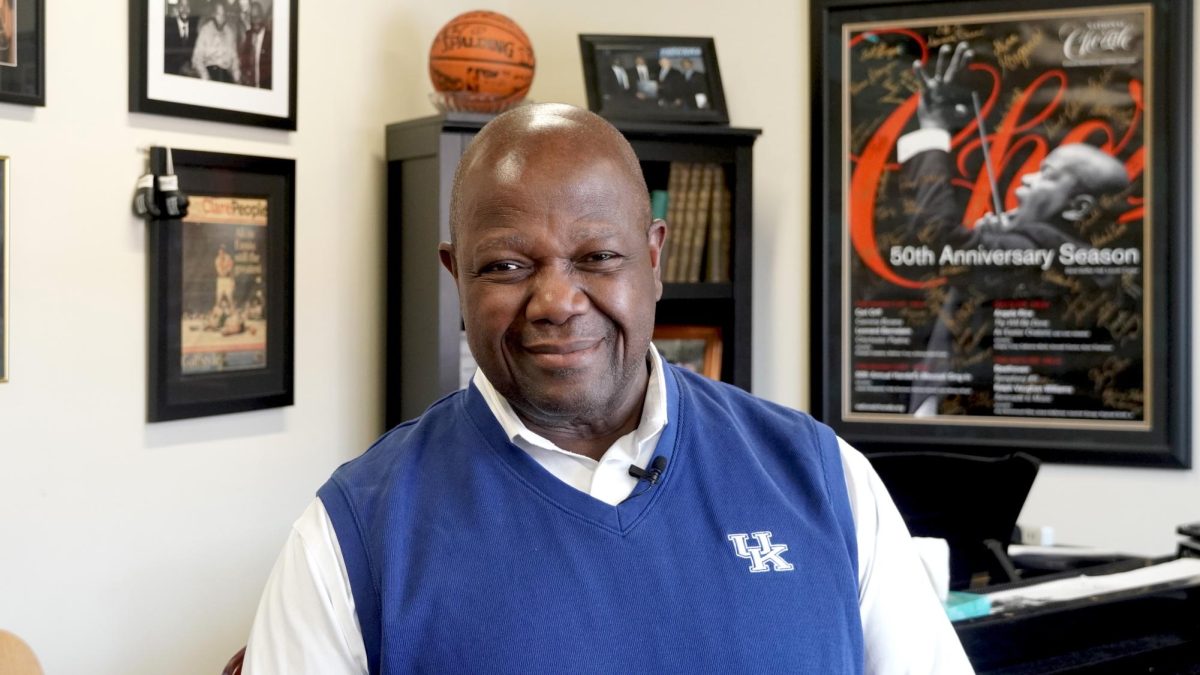

For example, someone could walk into the Emergency Room because they are having suicidal thoughts, and need to stay in the hospital for treatment. The physician would have to call the patient’s insurance company to justify their stay. Sometimes the request is accepted, but sometimes it is also denied and the patient then receives a large bill that they may not be able to pay. This is a problem that will likely get worse if insurance companies are not required to cover mental health hospitalization, according to Dr. Matthew Neltner of UK’s Department of Psychiatry.

“You might not realize how big of a problem that is until you have a loved one who needs three days in the hospital for suicidal thoughts, or a month in the hospital for an eating disorder, or rehab for a substance addiction,” Neltner said. “If this is the case, only wealthy people will really be able to afford treatment.”

People don’t always realize their insurance plan limits these types of care until they actually need it.

Roughly 50 percent of psychiatrists work on a fee-for-service basis because it is an enormous hassle to fight insurance companies for payment, and there are people who will pay cash for good mental health help, according to Neltner. Therefore, people who don’t have the money may not be able to afford the access to the care they need.

Another problem is the price of prescription medication, which can be extremely high, regardless of if it is the generic brand or not.

“Drug companies are not pricing most drugs based on normal economic principles of supply and demand,” Neltner said. “So, costs are astronomically high, and insurance companies limit what a doctor can prescribe by prior authorization.”

Neltner said that he was referred a young patient who was addicited to opioid painkillers. At first, the patient was not interested in treatment, but over a series of sessions and by investing a lot of time and effort with motivational interviewing, he was off of the painkillers and onto Buprenorphine. This worked out great for about six months until he had to switch insurance companies.

The new insurance did not want to pay for this medication. Neltner spent about three hours on the phone arguing with the insurance company.

“Let me describe that process to you. It was a long series of phone calls dealing with robotic prompts where you are asked to punch in the patient’s ID number and other data into the phone, followed by a real operator who asks for all the exact same information,” he said. “This can go on in endless loops, and to my knowledge, it is not regulated by any government agency, so insurance companies can do this all day long. They rejected the medication, and my patient gave up and relapsed, this time on heroin.”

There are serious consequences to insurance companies not providing mental health coverage. It can truly be a life or death situation. With the number of people suffering from a mental illness rising, there is a great need for insurance coverage to aid in recovery, much like they do for physical injuries.

Email opinions@kykernel.com.