Impact of Herald-Leader’s agricultural tax break series looks promising

February 27, 2016

It is hard to predict whether a newspaper story will provoke change or if it will quietly fade into the archives. For the Lexington Herald-Leader’s series on Kentucky’s farmland preservation tax break, the scales seem to be leaning toward the side of impact.

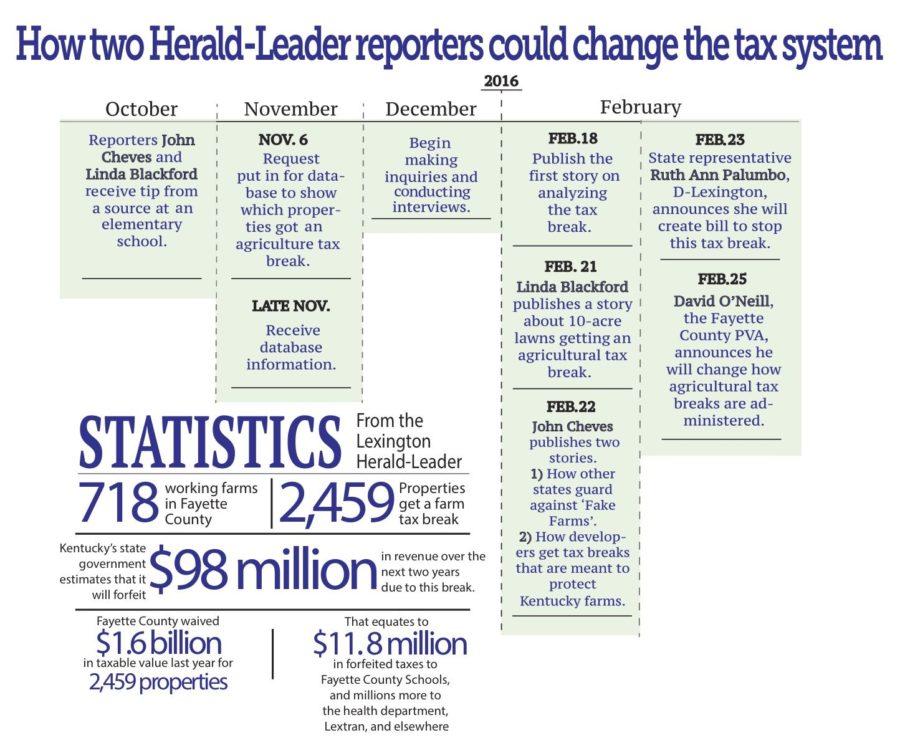

The series, written by reporters Linda Blackford and John Cheves, explained Fayette County’s curious and common system of allocating the agricultural tax break.

Their investigation showed that any plot of land larger than 10 acres receives the tax break, whether it is a working farm or not, and it looks like the series might make substantial change in Lexington — perhaps even statewide.

Fayette County Property Valuation Administrator David O’Neill, in an op-ed to the Herald-Leader, said he would take immediate steps to restrict who can receive the tax break, which was originally implemented in 1969.

State Representative Ruth Ann Palumbo, D-Lexington, said she would introduce a bill to stop nonfarmers from receiving the break.

The story began with a tip from someone at an elementary school.

How the agricultural tax break is allocated “had been on the books forever, and nobody had ever asked any questions about it,” Cheves said.

“The outrage came from everyone who felt they were paying more than their fair share,” Cheves said. “I’m glad that it’s having some impact.”

Readers should stay tuned, though, as Cheves said nothing has actually happened yet. Talks of change are a good sign, but if the outrage stops, so could any legislation or changes to the Fayette County PVA policies.

Stories like the one told by Cheves and Blackford could be swept under the rug, but the number and scope of people talking about Fayette County’s agricultural tax break is promising, and it is a pleasant reminder of the power of well-crafted journalism.

Email [email protected]